n is the number of values, so in this case is 9. Now add up these results (this is the 'sigma' in the formula): 139.55ĭivide by n. x refers to the values given in the question. Now, subtract the mean individually from each of the numbers given and square the result. The standard deviation is given by the formula:įind the standard deviation of 4, 9, 11, 12, 17, 5, 8, 12, 14 Non-grouped data is just a list of values. This video shows you how to calculate the Standard Deviation.

Just like when working out the mean, the method is different if the data is given to you in groups. If a set has a low standard deviation, the values are not spread out too much. However, the second is clearly more spread out. For example, the mean of the following two is the same: 15, 15, 15, 14, 16 and 2, 7, 14, 22, 30. It is useful in comparing sets of data which may have the same mean but a different range. Investments that have a higher standard deviation may be more volatile, and could be prone to larger price swings.The standard deviation measures the spread of the data about the mean value.

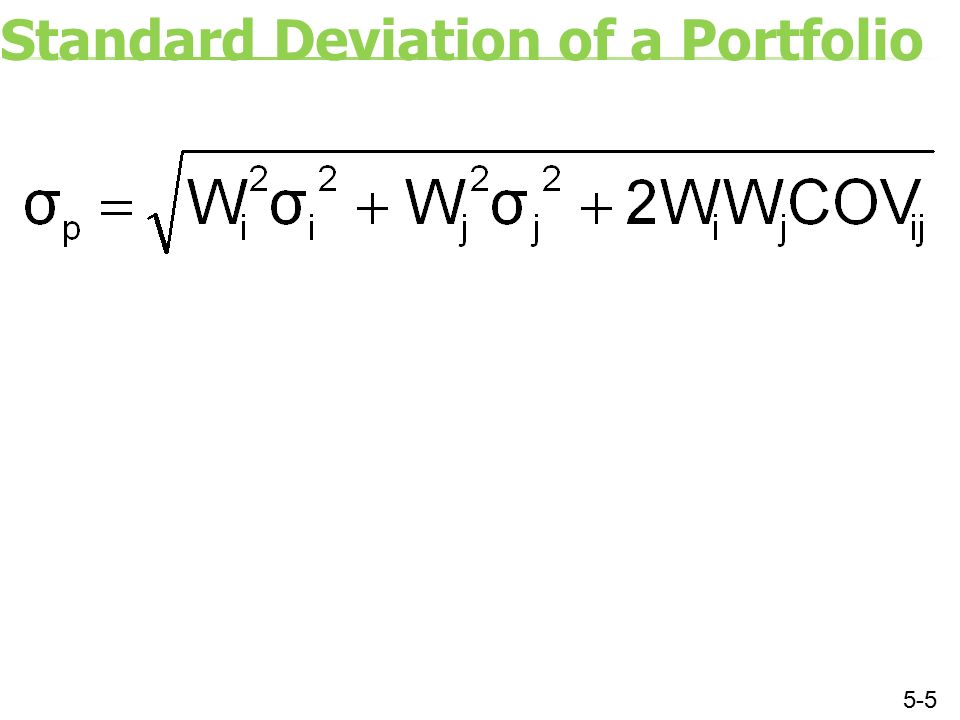

Standard deviation - also referred to by the Greek letter sigma (σ) - measures how far an asset's returns have been from its average return in a specific period. Within investing, which is what we'll focus on, an asset or portfolio's standard deviation is one way to assess its potential volatility. Standard deviation is used in many fields and situations to help determine a data point's distance from a data set's average.

Higher volatility may be riskier as big price swings can be hard to stomach and may make predicting an investment's returns more difficult.

One of these risks is related to an investment or a portfolio's volatility. Investors need to consider different types of risk when they're choosing which investments to buy and sell. A high standard deviation can indicate the asset's returns will be more volatile.You can quickly calculate or look up the standard deviation of different assets.An asset's standard deviation tells you how much its particular and average returns vary.

0 kommentar(er)

0 kommentar(er)